Bitcoin Boosted By Shutdown & Stimulus Optimism

BTC Bouncing Higher Today

Bitcoin prices are on watch this week following a sharp move higher off the November lows today. The market gapped open as traders welcomed news that the US govt shutdown looks to be coming to an end. The passing of a bipartisan bill through the Senate has fuelled a surge in optimism today with risk assets higher across the board. The bill now needs to receive support I the House of Representatives with traders awaiting news on when that vote is likely to take place. With the Thanksgiving holiday getting closer, traders are hopeful that a deal can be announced, ending the shutdown, ere that time. If we see furtehr positive headlines this week, this should keep crypto price supported amidst the broader risk on moves we’re seeing.

Trump Stimulus Plans

Bitcoin is also being boosted this week by news of Trump’s stimulus plans. Speaking over the weekend, trump outlined plans to grant US citizens a $2000 stimulus cheque, funded by US trade tariff profits. The president signalled that most citizens, expect those classed as high-earners, will receive the cheque. Previous stimulus operations have typically fuelled a surge in crypto trading and investment. As such, news of the plan is being seeing a supporting factor for BTC. If we get confirmation and timing details this should help furtehr bolster sentiment, lifting BTC higher near-term.

Technical Views

BTC

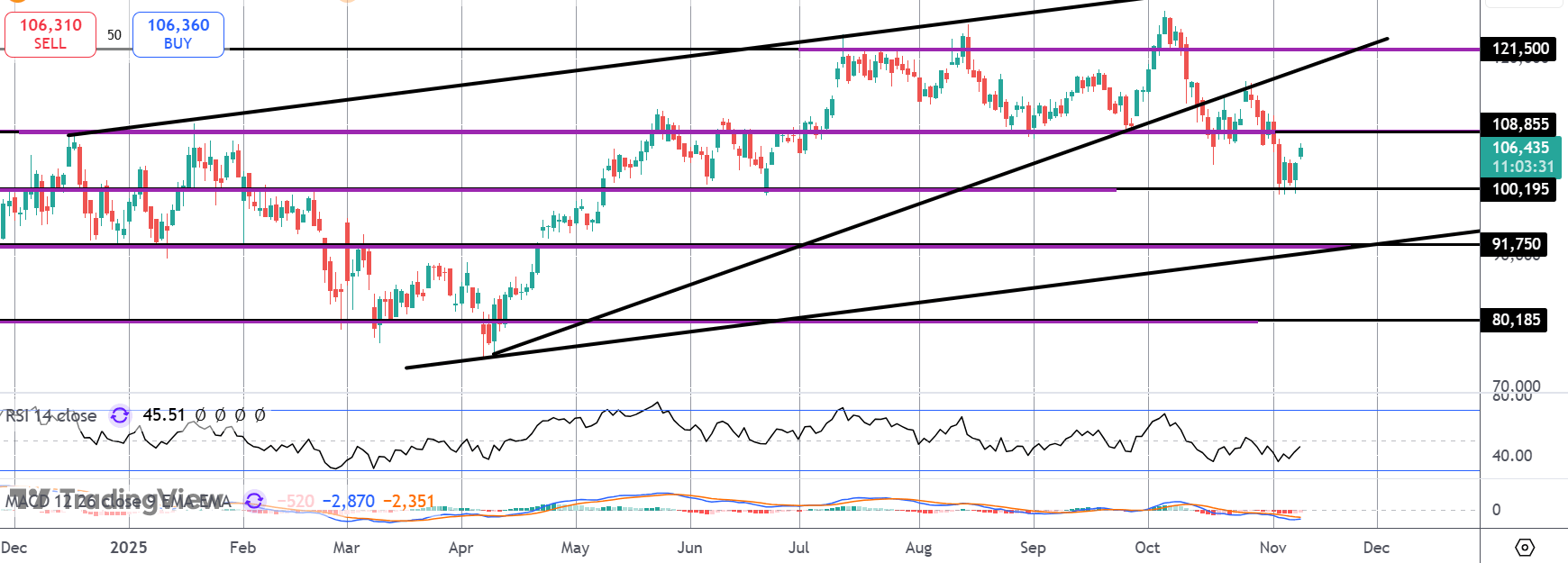

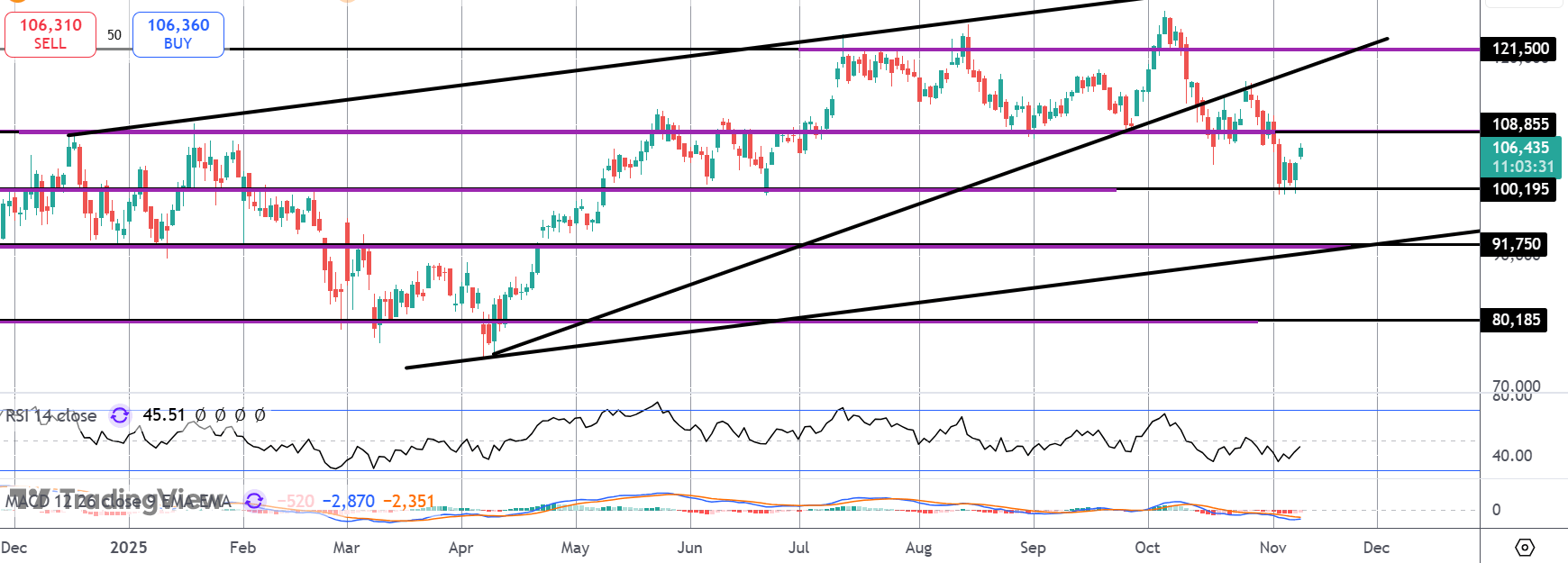

The sell off in BTC has stalled for now into the $100k mark with price bouncing higher today. Focus is now on the $108,855 mark. This is a key pivot of the market with a failure here putting focus back on downside risks and broader reversal. If bulls can get back above this level, however, this should alleviate downside risks, putting focus instead on a return to YTD highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.