SP500 LDN TRADING UPDATE 29/1/26

SP500 LDN TRADING UPDATE 29/1/26

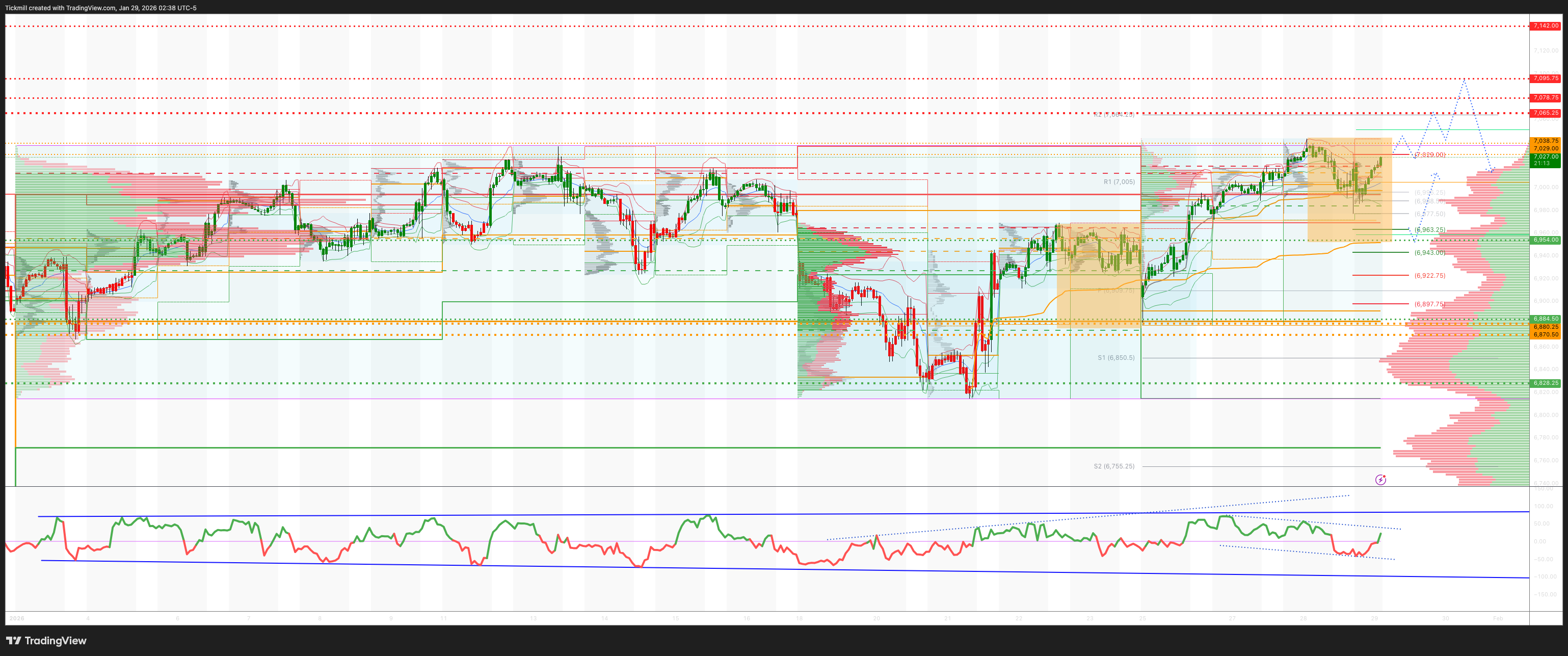

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6880/70

WEEKLY RANGE RES 7065 SUP 6928

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The Gamma Flip Zone at 6972.75 is crucial; above it, the market experiences “Positive Gamma” with reduced volatility and easier upward movement. Below it, “Negative Gamma” results in erratic price action. Bulls must reclaim this level to stabilise the market.

DAILY VWAP BULLISH 6969

WEEKLY VWAP BEARISH 6961

MONTHLY VWAP BULLISH 6856

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6988

WEEKLY STRUCTURE – BALANCE - TBC

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

DAILY BULL BEAR ZONE 6929739

DAILY RANGE RES 7077 SUP 6954

2 SIGMA RES 7142 SUP 6884

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.37

TRADES & TARGETS

PRIMARY PLAY - LONG ON ACCCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON TEST ON REJECT/RECALIM DAILY RANGE SUP TARGET 7013 > DAILY BULL BEAR ZONE > WEEKLY RANGE RES

SHORT ON REJECT RECLAIM DAILY/WEEKLY RANGE RES TARGET 7040

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “Positive Undertones”

S&P closed down 1bp at 6,978 with a Market-On-Close (MOC) imbalance of $2.25 billion to sell. NDX rose 32bps to 26,023. R2K dropped 49bps to 2,654, while the Dow gained 2bps to 49,016. A total of 18.93 billion shares traded across all US equity exchanges, above the year-to-date daily average of 18.34 billion shares. VIX increased 80bps to 16.48, WTI Crude climbed 160bps to $63.38, US 10YR remained unchanged at 4.24%, gold surged 398bps to 5,387, DXY rose 16bps to 96.37, and Bitcoin slipped 14bps to $89,066.

Micro factors outperformed macro influences, with a positive tone in semiconductors due to strong micro-level developments in companies like ASML, TXN, STX, and NVDA. Key takeaways include: 1) revenue and demand stories surpassing high expectations, and 2) stocks performing well despite elevated positioning and expectations. After-hours, MSFT fell 7% due to a slight deceleration in Azure growth at 38% (positioning scale: 7.5/10), while META dropped 2% despite a strong Q1 revenue guide, weighed down by higher capex and expense projections (positioning scale: 7/10). TSLA rose 3% after beating EPS and EBITDA estimates, with gross margins exceeding expectations (positioning scale: 6/10). Investor sentiment suggests both long-only (LO) and hedge funds (HF) favor TSLA.

Overall activity levels were rated 6/10, with the floor ending at -860bps for sale compared to a 30-day average of -105bps. Asset managers were balanced, while hedge funds were slight net sellers, driven by short supply in macro, tech, and financials. Buying activity was notable in software and staples, with the latter showing resilience even amid a renewed focus on tech. There are indications of funds shifting from retail (due to cold weather) toward defensive consumer sectors. MO earnings are upcoming, with Friday's HPC reports from CL, CHD, and CHD's investor day being more critical.

The FOMC meeting was a non-event, as the Fed maintained the target range for the federal funds rate at 3.5-3.75% in January. However, Governors Waller and Miran dissented, favoring a 25bps cut. The post-meeting statement described economic growth as "solid," mentioned stabilization in the unemployment rate, and removed references to labor market downside risks.

In derivatives, despite positive overnight semiconductor earnings, the S&P briefly breached the 7,000 level but failed to sustain it, partly due to the dealer gamma pocket. Dealers remain max long at 1-2% above the current spot, likely requiring a catalyst to push the market higher. SPX volatility was stable, while NDX volatility rose, especially in the front end. Russell volatility held steady before the Fed decision but dropped sharply afterward. Skew performed well across SPX/NDX, particularly in the front end, as investors awaited mega-cap tech earnings. Flows showed more hedging than chasing activity, with a notable SPX Dec27/Dec29 put spread bought 2,500x (12mm big-side vega, 3mm net vega). Tomorrow’s straddle closed at 74bps.

Earnings Highlights After Hours:

- MSFT: -7% (positioning scale: 7.5/10) – Azure growth decelerated to 38%.

- META: -2% (positioning scale: 7/10) – Strong Q1 revenue guide but weighed by elevated capex and expense guidance for FY26.

- LRCX: +1% – Solid beat and raise.

- NOW: -3% – F4Q cRPO +21% y/y cc vs. guide of +19% y/y cc; CY26 subscription revenue guidance at +19.5-20% y/y cc; $5B buyback announced.

- IBM: +7% – Software revenue accelerated to +11% y/y cc; CY26 guidance >5% y/y cc revenue growth with +$1bn y/y FCF.

- TSLA: +3% (positioning scale: 6/10) – EPS and EBITDA beat with strong gross margins; positive investor feedback.

- CHRW: +6% – EPS beat on lighter top-line results (light volume).

- LUV: +4.5% – Slight EPS beat and Q1 guidance above expectations.

- TTEK: +5% – Beat and raise

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!